June 15, 2016

IMPORTANT UPDATE: On Tuesday, November 22, 2016, a U.S. District Judge suspended the December 1, 2016 implementation date of overtime rule changes in the Fair Labor Standards Act. While many businesses may be breathing a sigh of relief because they were in danger of non-compliance, the judge’s order may be merely a temporary reprieve. CLICK HERE to learn more.

In a recent post, I provided an overview of the Department of Labor’s new overtime rules, set to take effect December 1, 2016. This revision to the Fair Labor Standards Act (FLSA) increases the salary threshold for workers who can receive overtime pay. In short, the new threshold raises the salary level for eligible workers to $47,476 per year, which is slightly more than double the amount in the prior overtime rules.

While the earlier post provided essential information about the new overtime rules and their important changes, questions remain. In this post, I’ll answer some of the common questions I’m hearing from corporate employers and their HR staffers and employee compensation specialists.

The New Overtime Rules – a Q and A Session

Question: How many workers are really affected by the new overtime rules?

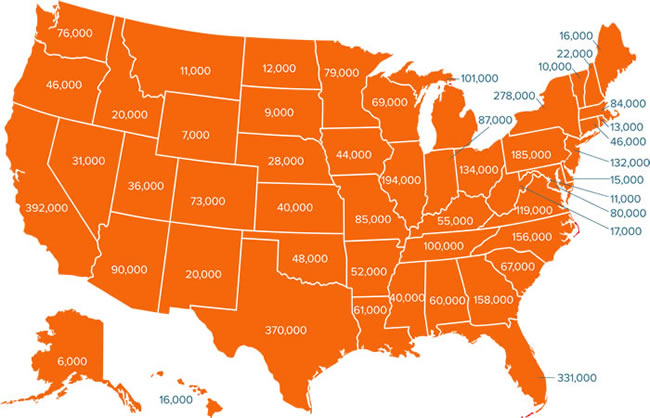

Answer: The Department of Labor estimates more than 4.2 million U.S. workers will be affected. They have provided the map below to show how many wage earners are likely to be impacted in each state. (You can click the map to enlarge it.)

Q: Can you now have part-time and full-time employees (some non-exempt and some exempt) in the same job code?

A: Yes. You have always been able to do this, but the salary threshold was so low, it was seldom an issue. With the higher salary threshold, however, this question becomes important. Just remember: non-exempt employees must track and report hours worked weekly; and they must be paid overtime for time worked in excess of 40 hours in a work week.

Q: If we have two employees in the same job title (with job duties that qualify for exemption), but some employees don’t meet the salary threshold while others do, can we have them in the same job code?

A: Yes, you can. However, you would want all employees actually performing the same job duties to be able to pass the job duties test. You may want to take a closer look and decide if you really have two jobs in this scenario; perhaps a junior and senior level that should have different job codes. Be aware that certain employee relations issues could arise if you leave them in the same job code.

Q: How long do we have to do make-up on an employee’s salary if we are going to exercise the up-to-10% non-discretionary bonus to hit the salary threshold?

A: Whether you pay monthly or quarterly non-discretionary bonuses, you have one paycheck following the end of the quarter to complete the true-up payment. In other words, when utilizing this option, you must be able to calculate non-discretionary bonus payments at quarter’s end, calculate the true-up, and then pay it all within one pay period.

Q: Have there been any changes to the outside sales exemption?

A: No. Job duties remain the same and there is no minimum salary threshold.

Q: Is there a different salary threshold for IT positions if they are paid hourly?

A: Yes. If you are paying an IT employee hourly, the minimum hourly salary to be eligible for exemption status is $27.63/hour (and the position must meet the job duties test as well). If you are paying an IT employee a salary, the minimum weekly salary amount to be eligible for exemption status is $913 (and again, the position must meet the job duties test).

Q: If I classify employees as salaried non-exempt, do other non-exempt regulations apply?

A: Yes, you can pay an employee a salary for all hours worked in any given week up to 40 if they are salaried non-exempt. However, all other non-exempt regulations apply such as keeping a record of hours worked and providing any break or rest periods required by state law.

The Bottom Line

As further review and discussion of the Department of Labor’s new overtime rules continue, the clock continues to tick for employers up to and beyond the December 1, 2016 implementation date. At Total Rewards Solutions, we continue to analyze areas impacted by these regulatory changes, and we stand ready to help employers interpret and apply them as part of their employee compensation and rewards programs. To learn more, contact us today at 317.589.8529.

Cassandra Faurote

About Total Reward Solutions:

Total Reward Solutions is your outsourced compensation services provider, dedicated to innovating total rewards that drive people and business excellence. Led by respected and professionally certified Human Resources expert Cassandra Faurote, Total Reward Solutions offers a broad range of compensation, benefits, performance management, and reward/recognition consulting services to help your organization attract top talent, motivate employees and retain top performers. Call us today at 317.589.8529 to discuss how we can help your organization develop and implement competitive and effective compensation and total reward programs.